The great pool industry heist: Professionals built the market—Now it is time to take it back

At 7 a.m. on a Saturday in June, the store opens and the team prepares for the weekend rush. The team spent Thursday night training on the new hydroxyl fusion systems. The service trucks are loaded, and the water lab is calibrated. A typical dealer may invest tens of thousands of dollars each quarter in inventory, training, and marketing to create demand for backyard living.

By noon, the technician will have educated three families on the intricacies of pool chemistry, resolved two urgent green water emergencies, and scheduled four hot tub installations. However, a harsh reality lies ahead: those local customers—families that the technician has nurtured and continues to support—will often be poached. They will spend two out of every three dollars with mega mass merchants, big-box stores, and large online discounters, or more recently, omnichannel retailers that dominate the market.

The pool and spa/hot tub retailer created the demand. Its staff helped solve their problems and built the relationships. Yet, the recurring revenue flows to others.

The great Canadian pool, swim spa, and hot tub market shift—where mass merchants and online giants capture the recurring revenue that sustains local businesses, while industry professionals continue to bear the full costs of keeping the industry alive.

The numbers do not lie (and are infuriating)

To understand the current reality facing Canadian backyard leisure professionals, it is necessary to confront some uncomfortable facts. For every dollar of recurring revenue earned from customers developed and supported by local pool and spa retailers, mass merchants now capture two. These large retailers have transformed water care products—the foundation of the industry’s business model—into loss leaders, deliberately underpricing them to attract consumers into their weekly shopping routines.

The consequences for independent pool and spa businesses are significant. Their success relies on three essential pillars: new water sales, service and repairs, and recurring revenue. That third pillar—the steady stream from chemicals, parts, and supplies—is not merely a profit source; it is the foundation of business stability. It can transform a decent year into a profitable one, sustain operations when new installations decline, and help fund local employment and community activities.

And increasingly, that revenue is being lost in plain sight.

The economic devastation extends further. When customers purchase from a local, independent Canadian business, 66 cents of every dollar remains in the community, generating jobs, supporting local sports teams, and funding charities. In contrast, when they buy from big-box stores, only 11 cents of the purchase price stays local. Online discounters contribute an even smaller amount—a mere eight cents.1 This situation represents not only unfair competition but also the extraction of community economic resources on an industrial scale.

The industry has been here before (and it won)

Here is what the mega-merchants do not want the public to remember: the pool and spa industry has already beaten them once. Flash back to 1975, mass merchants flooded the market with extremely low-priced calcium hypochlorite after the industry pros had endorsed it and established the market. Customers were leaving the pro channel in large numbers, causing industry retailers to suffer as a result. This situation sounds familiar.

However, Canadian pool and spa professionals did not give up. They launched what the author calls the industry’s first moonshot—a bold, audacious reinvention that seemed impossible until it ultimately was not.

Pro-only manufacturers and the “I have had enough” professional backyard leisure specialists formed an unprecedented partnership to decommoditize water care. They championed and promoted the replacement of calcium hypochlorite with a science-based, systems approach by introducing the three-step water care system—simple water chemistry, effectively programmed. This initiative was not just a product launch; it represented a declaration of war against commoditization. Manufacturers committed to exclusive professional distribution, while dealers dedicated themselves to education and expertise. Together, they transformed water care from a race to the bottom into a professional service that only dealers could provide.

They pioneered computerized water testing, turning stores into laboratories of expertise. They developed personalized water prescriptions, ensuring that each customer interaction became a consultative experience rather than simply a transaction.

Most importantly, they shared a new narrative. Water care was no longer about chemicals; it focused on maximizing “problem-free, swimmable days.” They made themselves indispensable.

The results? By the year 2000, they had dramatically reversed the bleeding, reclaiming dominant market position from what had been a devastating collapse. The industry did not merely survive; it dominated.

The industry built a Trojan horse

The industry acknowledges its mistakes and understands the importance of taking responsibility for them.

Despite introducing a brilliant three-step system, it has remained unused for over 50 years. While the industry became complacent, the world changed. Amazon emerged, big-box stores got sophisticated, and consumers grew comfortable with purchasing everything online. As a result, the once-innovative system became a commodity that anyone could copy and replicate at a lower price.

Essentially, the industry built its own Trojan horse and invited the competition right through the gates.

Today, the market share pendulum has swung dramatically back toward mass merchants—a painful reversal that mirrors the crisis of the ’70s. These opportunistic businesses are not only capturing chemical sales but also targeting the equipment market. They sell to professionals at “dealer pricing” while simultaneously marketing directly to customers at prices that match the professionals’ costs. They are not partners; they are predators.

The hidden crisis: Where did all the women go?

There is another uncomfortable truth the industry must face. In the ’80s, women were a significant force in the retail workforce—not just present, but thriving as champions of relationship-based selling, customer education, and loyalty building. Walk into any successful pool store during that era, and one would find women at every level: managing water labs, leading sales teams, and building the recurring customer relationships that sustained these businesses through seasonal fluctuations.

Today, that presence has collapsed dramatically. Women have largely exited the industry. It is not a coincidence that this decline coincides with the collapse of the industry’s recurring revenue model.

Women did not leave because they were unable to perform the job. They exited because the industry failed to evolve, failed to create inclusive environments, and failed to provide them with seats at the decision table where they rightfully belonged. Their relational strengths and ability to build trust and community were not just advantageous traits; they served as competitive advantages. By neglecting these qualities, the industry disarmed itself.

The second moonshot: A strategic blueprint for recovery

The industry is no longer playing by the rules of mass merchants, and it is time for the second moonshot. This time, the industry possesses capabilities its predecessors could only dream of.

- Deploy science that cannot be copied

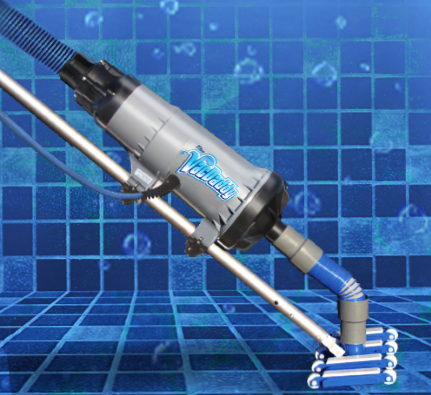

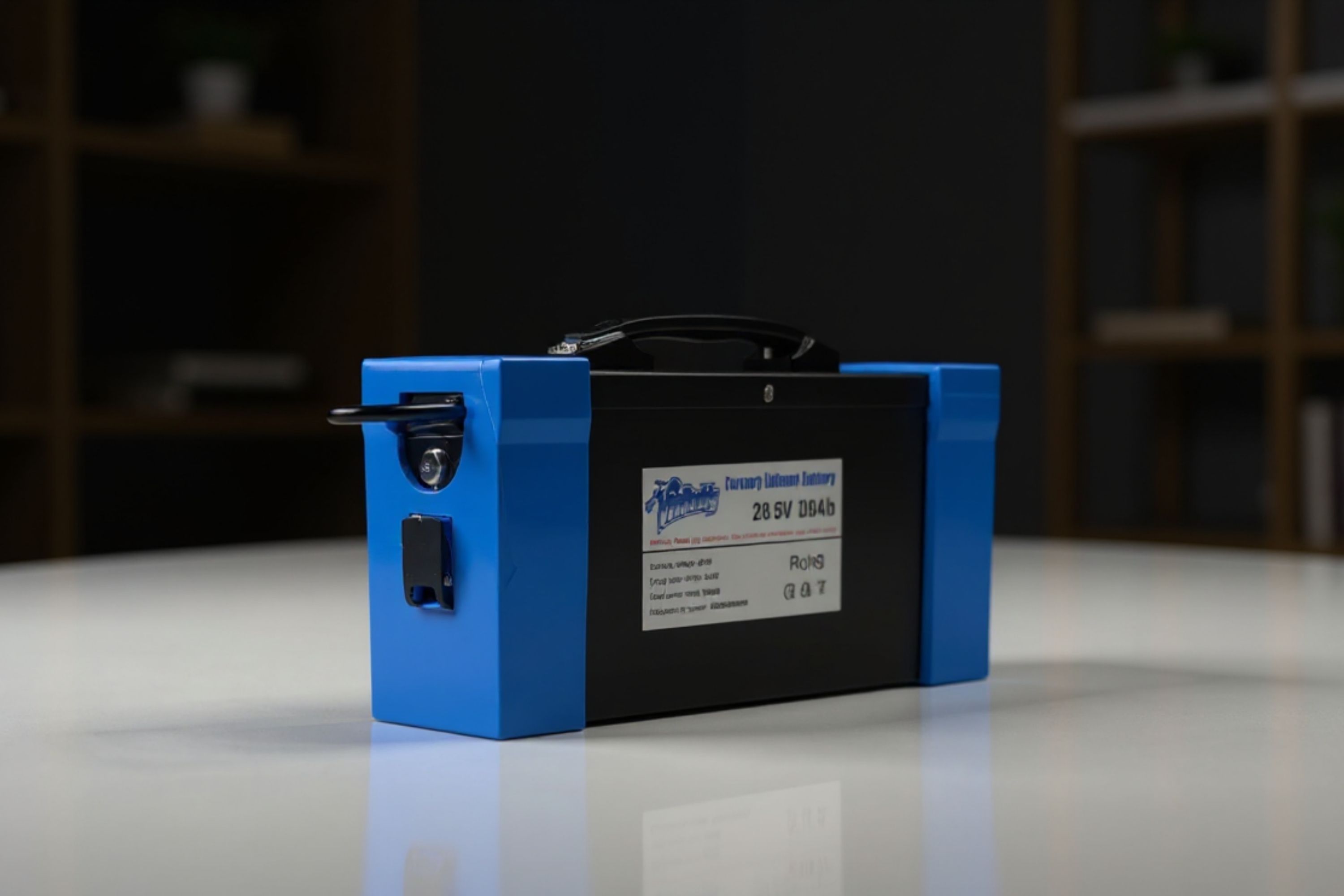

This is not about incremental improvements; it is about transformation. Mineral fusion technology is redefining water as a wellness resource. Hydroxyl radical systems—the most powerful natural oxidizers—deliver drinking-water quality without harsh chemicals. These are not products that mass merchants can easily stock on their shelves.

They demand expertise, explanation, and education. They demand the guidance of knowledgeable industry professionals.

When customers experience water that feels silky, does not irritate the eyes or skin, and enhances their overall sense of backyard wellness, price becomes secondary. Competing with big-box retailers on cost alone becomes unnecessary, as customers will value the results that only a more advanced approach to water care can deliver.

- Harness artificial intelligence (AI) for training

Millennials and Gen Z employees do not learn from binders; they learn from short, visual, and interactive content (i.e. TikTok and YouTube). Providing accessible, on-demand knowledge gives staff the tools they need to succeed—right in the palm of their hand. Imagine a new employee using a mobile device to instantly access expert guidance on water science, problem identification, troubleshooting protocols, product features, benefits, and step-by-step directions.

This same intelligence can extend to in-store “We Have Answers” kiosks, where both customers and staff can receive expert information within seconds. Team members no longer need to memorize which phosphate remover pairs with a specific sanitizer system—the AI assistant knows. Nor do they need to recall the exact process for treating pink slime versus white water mould; it is right there on their screen, with photos, videos, and guided instructions.

This is not a futuristic concept. It is now available exclusively to professional dealers. While big-box stores struggle with entry-level staff who may lack even basic knowledge of water chemistry, industry professionals have the opportunity to develop teams that operate like water care scientists, equipped

with the expertise of the industry’s leading minds at their fingertips.

Training is evolving from annual events to always-on micro-learning. Every customer interaction becomes a teaching opportunity. Every challenge becomes solvable. Each team member—whether newly hired or highly experienced—can perform with the confidence and capability of a seasoned professional.

- Rebuild with diversity as a strategy

Expanding gender diversity in the workforce is not about being politically correct; it is about performance and progress. Creating flexible scheduling that accommodates parents, establishing clear advancement paths, and placing women in decision-making roles where their perspectives influence strategy, not just execution.

Companies with diverse leadership teams can outperform homogeneous ones by as much as 35 per cent.2 This is not charity; it is a competitive advantage.

- Reframe the entire conversation

The industry must stop selling chemicals and start selling outcomes. Customers do not purchase chlorine for the product itself—they buy it to ensure their daughter’s birthday pool party is perfect. They do not want a pH increaser; they want relief for their arthritis in the hot tub. They do not buy algaecide; they want their backyard to be the envy of the neighbourhood.

Mass merchants sell products. Industry professionals sell experiences—dreams, health, and family memories. That distinction must be made impossible to ignore.

The professional’s advantage

The future belongs to dealers who deliver what can be called Pure WOW 2.0:

- Performance that astounds—water so perfect it meets drinking standards, delivered through technologies mass merchants cannot fathom.

- Style that resonates—positioning backyard experiences within the $4.42 trillion global wellness economy, not the commodity chemical business.3

- Substance that endures—proven science, measurable results, and the expertise that turns first-time buyers into lifelong advocates.

In the ’80s and ’90s, dealers routinely followed up with every customer after a sale—much like a physician’s office checking on a patient’s recovery. They asked, “Did the algaecide work?” “Is the water crystal clear?” “How does the new mineral system feel?” These follow-up calls transformed a simple transaction into a relationship, a product into a solution, and a dealer into a trusted advisor.

The degree to which this discipline still exists serves as a measure of professional strength. If this practice has faded, it likely signals that other small but critical “Pure WOW” procedures have also disappeared—habits that once distinguished specialty retailers from commodity sellers.

The good news is that this can be reignited immediately. Start calling. Start caring. Start proving that substance is not just in the product—it is in what happens after the sale.

This is not about competing with mass merchants; it is about rendering them irrelevant.

The choice is yours: Victim or victor

Today, the industry stands at a crossroads much like it did in 1975. The situations feel overwhelming, the competition appears unbeatable, and the economics seem stacked against independent professionals.

Yet this generation holds advantages its predecessors never had: proof that moonshots work, with access to technologies once unimaginable, and tools that previous leaders could only dream of. Most importantly, the industry possesses the very playbook that once defeated mass merchants—and it can do so again.

Large retailers are counting on complacency. They are betting that professionals will remain on the defensive, cutting prices and watching margins evaporate. They are betting that businesses will quietly accept decline as inevitable.

It is time to prove them wrong. Begin now. Choose one new technology—mineral fusion, hydroxyl radicals, UV-C, or ozone—and become the recognized expert. Train one staff member to be its champion. Convert one customer from commodity chemicals to premium science. Then build from there.

This is the industry’s Apollo moment

In 1969, humanity looked to the moon and said, “We are going there.” It seemed impossible. The technology was nascent, the risks were enormous, and the skeptics were loud. Yet the mission succeeded—because when faced with the impossible, humans find a way to make it possible.

The industry’s moonshot is not about reaching space; it is about reclaiming its own space. It is about taking back the recurring revenue that rightfully belongs to the professionals who create and sustain it. It is about proving that Canadian independent dealers are not just survivors—they are innovators, competitors, and leaders.

Mass merchants may believe they have already won. They assume the future belongs to them.

They are mistaken. Independent professionals are more than retailers—they are scientists, problem solvers, and guardians of summer memories and backyard dreams.

Now is the moment for the industry to remind both the marketplace and its professionals of what that truly means. The moonshot begins today.

Notes

1 For more, read “Small Business, Big Impact: Small Retailers’ Local Contributions” article on the Canadian Federation of Independent Business (CFIB) website.

2 See the report by McKinsey & Company titled “Diversity matters even more: The case for holistic impact,” December 5, 2023.

3 Refer to “Research Report-The Global Wellness Economy: Looking Beyond Covid,” a report published by Global Wellness Summit. Read the report.

Author

Dennis Gray, founder and chief troublemaker of Backyard Brands Inc., has more than 40 years of experience developing and marketing advanced water care technologies. A former BioLab group president, he now leads Backyard Brands’ mission to create high-performing, sustainable water care solutions for professional dealers across North America.